A Power of Attorney Guide for Property

Balancing Care and Responsibility Managing a parent’s or anyone’s financial affairs through a Power of Attorney for Property (POA) can be both challenging and a significant responsibility. As a Power of Attorney, you step in if someone cannot manage their own financial affairs. This guide outlines the process and explains what you may be required […]

Smart Tax Strategies for Retirees: Take Advantage of Key Tax Credits

As a retiree, there are a few tax credits you should be aware of which may reduce your tax bill. Every dollar you save in tax means either more spending and/or preserving your wealth for you.

How to Prepare for the Next Big One.

The last event I attended prior to COVID was the Daytona 500 in February 2020.

You may be wondering how a NASCAR race relates to the topic of retirement income planning?

Key Points for Wills and Powers of Attorney’s

After COVID-19 families realized they should focus on planning the family’s future. One of the most difficult challenges a Certified Financial Planner® has is to encourage clients to update and/or review their estate plan and documents. Often families tend to put this off, as it is not seen as urgent. However, the trauma of COVID-19 […]

Smart Tax Strategies for Retirees: Tax Efficient Income Withdrawals

One of the most important decisions a retiree must make is how to create an income and cash-flow strategy from the financial assets they have accumulated over their lifetime.

Smart Tax Strategies for Retirees: Income Splitting

Income tax is one of the largest expenses any retiree has. A smart tax strategy to reduce a family’s overall tax burden is to split the income. This means to shift income from a spouse or common law partner (CLP) who is in a higher tax bracket to one who is in a lower tax bracket.

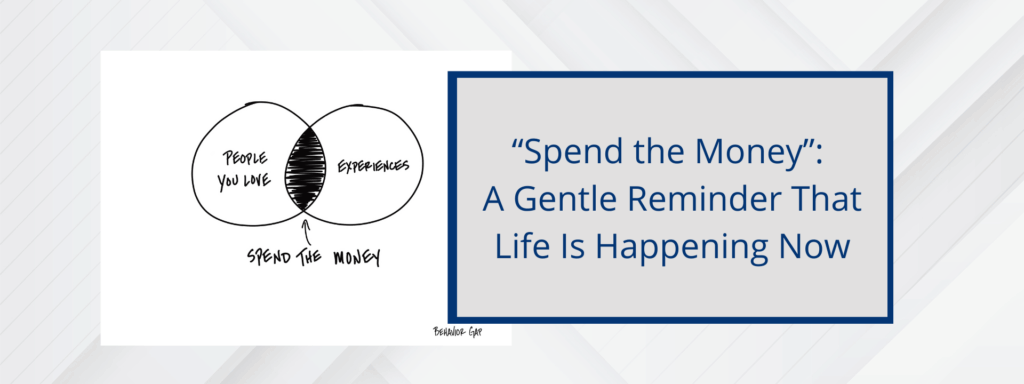

“Spend the Money”: A Gentle Reminder That Life Is Happening Now

Intro: If you’ve ever felt guilty about spending your own money—even after a lifetime of saving – it turns out, you’re not alone. In a recent chat with Carl Richards, creator of The Sketch Guy and author of the new book Your Money: Reimaging Wealth in 101 Simple Sketches, we talked through one of his […]

“Why Being ‘Less Wrong’ Might Be the Best Plan”

Ever feel like your financial plan has to be perfect? It doesn’t. In fact, trying to make it perfect can actually hold you back. I recently had the chance to speak with Carl Richards, author of the new book Your “Money: Reimaging Wealth in 101 Simple Sketches” — and one idea from our conversation really […]

The Story of Chandler and Monica Retiring with Confidence

How Chandler & Monica Went From “Do We Have Enough?” to Retiring with Confidence Chandler (70) and Monica (73) were in a solid financial position on paper: They had saved diligently and avoided debt for decades. But as Chandler’s April 30, 2025 retirement date approached, they started to worry: They knew they wanted to accomplish […]

Three of our Best Insights for August

Our Monthly 3-2-1- Newsletter RESOURCE: Preserving Wealth: Chapter Four, Tax Concerns, RRSPs and TFSAs. Uncle Wayne, with his wealth of financial knowledge, shared invaluable lessons on tax concerns, RRSPs, and TFSAs. Understanding these concepts can significantly impact your financial planning and retirement success. In this chapter summary, we’ll walk you through the essential lessons and […]