Key Points for Wills and Powers of Attorney’s

After COVID-19 families realized they should focus on planning the family’s future. One of the most difficult challenges a Certified Financial Planner® has is to encourage clients to update and/or review their estate plan and documents. Often families tend to put this off, as it is not seen as urgent. However, the trauma of COVID-19 […]

Smart Tax Strategies for Retirees: Tax Efficient Income Withdrawals

One of the most important decisions a retiree must make is how to create an income and cash-flow strategy from the financial assets they have accumulated over their lifetime.

Smart Tax Strategies for Retirees: Income Splitting

Income tax is one of the largest expenses any retiree has. A smart tax strategy to reduce a family’s overall tax burden is to split the income. This means to shift income from a spouse or common law partner (CLP) who is in a higher tax bracket to one who is in a lower tax bracket.

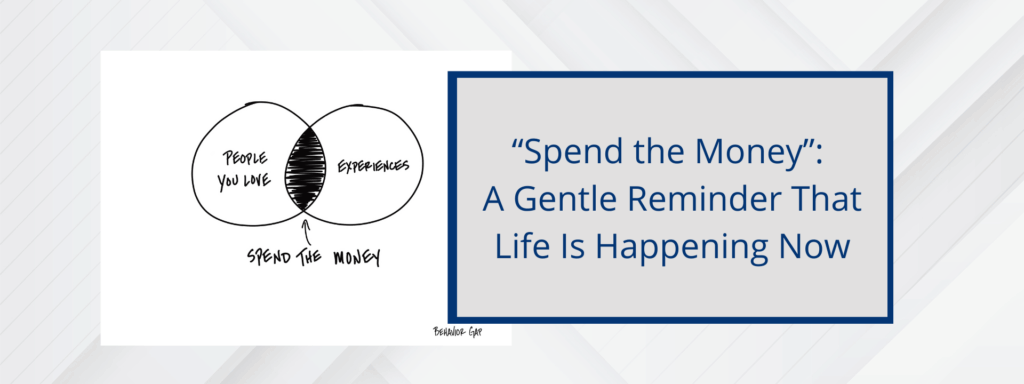

“Spend the Money”: A Gentle Reminder That Life Is Happening Now

Intro: If you’ve ever felt guilty about spending your own money—even after a lifetime of saving – it turns out, you’re not alone. In a recent chat with Carl Richards, creator of The Sketch Guy and author of the new book Your Money: Reimaging Wealth in 101 Simple Sketches, we talked through one of his […]

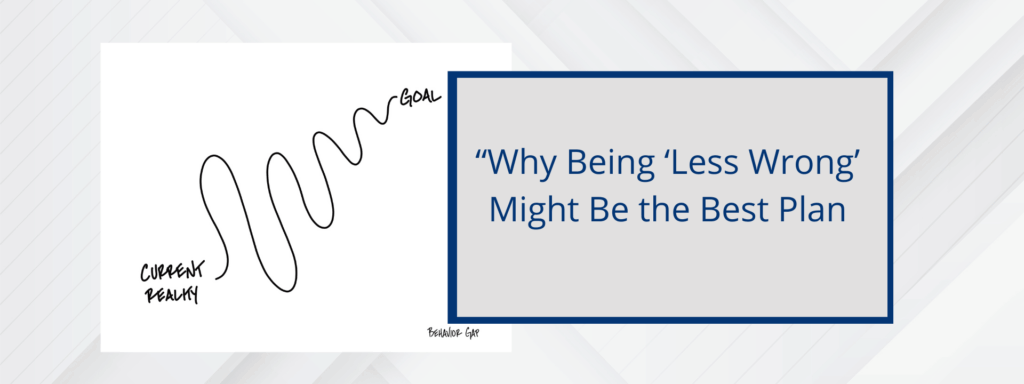

“Why Being ‘Less Wrong’ Might Be the Best Plan”

Ever feel like your financial plan has to be perfect? It doesn’t. In fact, trying to make it perfect can actually hold you back. I recently had the chance to speak with Carl Richards, author of the new book Your “Money: Reimaging Wealth in 101 Simple Sketches” — and one idea from our conversation really […]

The Story of Chandler and Monica Retiring with Confidence

How Chandler & Monica Went From “Do We Have Enough?” to Retiring with Confidence Chandler (70) and Monica (73) were in a solid financial position on paper: They had saved diligently and avoided debt for decades. But as Chandler’s April 30, 2025 retirement date approached, they started to worry: They knew they wanted to accomplish […]

Three of our Best Insights for August

Our Monthly 3-2-1- Newsletter RESOURCE: Preserving Wealth: Chapter Four, Tax Concerns, RRSPs and TFSAs. Uncle Wayne, with his wealth of financial knowledge, shared invaluable lessons on tax concerns, RRSPs, and TFSAs. Understanding these concepts can significantly impact your financial planning and retirement success. In this chapter summary, we’ll walk you through the essential lessons and […]

Questions to Ask When Interviewing a Financial Planner

Excerpts from the Book – Preserving Wealth – written by Jack Lumsden, MBA, CFP® Deciding on which financial planner to hire is a particularly important decision for families to make. The following are key questions that FP Canada has designed to help in the selection process. How to Interview a Financial Planner Financial planners can […]

Three of our Best Insights for July

Our Monthly 3-2-1- Newsletter RESOURCE: Preserving Wealth: Chapter One, What are the 7 Key Lessons for Inheritance and Financial Planning? In the first chapter of Preserving Wealth for the Next Generation, we are introduced to a family gathering at their father’s summer cottage in Honey Harbour. It’s the opening weekend of summer, but it’s filled with […]

How to Avoid Losing Money in the Stock Market

Lately, market volatility has been making headlines, leaving many investors wondering what they should do. Should you sell? Hold steady? Make changes? Before making any big decisions, let’s break down what “losing money” really means and how you can protect your investments. What Does It Really Mean to “Lose Money”? When people say they’re “losing […]