RETIREMENT INCOME PLANNING

Serving Burlington, Oakville & Surrounding Areas

Reduce Taxes ♦ Maximize Income Invest Smarter ♦ Preserve Wealth

"Your Goals, Your Retirement, Our Expertise"

What exactly is Retirement Income Planning?

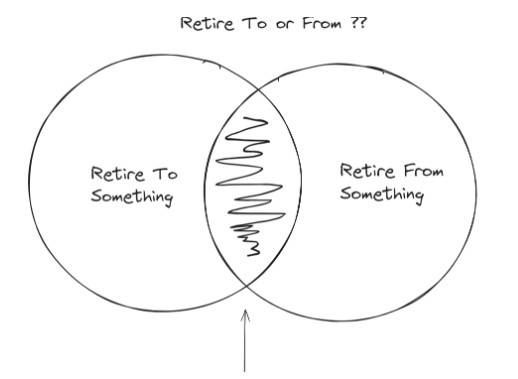

Retirement income planning is the process of creating a strategy to replace the monthly pay cheque you’ve been receiving for the past thirty to forty years from the financial assets you’ve accumulated over your lifetime.

Common Concerns of Retirees

- Making sure they can do the things they want in retirement,

- Maintaining consistent income for life,

- Paying less tax,

- Providing financial security for loved ones, and

- Transferring family wealth successfully to the next generation.

Our Retirement Planning Solution:

Create a retirement income & cash-flow strategy that includes but is not limited to:

- Documenting your current situation, income requirements and estate objectives.

- Creating a detailed income & cash-flow strategy that will:

- Outline if you can achieve your goals using cash-flow based financial planning software,

- Utilize ‘what if options’ to maximize your income & cash-flow plan,

- “Stress Test” your plan,

- Detail how to best sequence the withdrawal of income from your various income sources; (CPP/OAS/RRIFs/TFSAs etc.) to reduce taxes and increase asset longevity,

- Provide a strategy on how to best deploy your financial assets and investments to achieve your goals,

- Plan for health care and real estate assets as you age,

- Estimate of taxes and estate costs.

- Ongoing guidance, review, and annual update of your retirement income & cash-flow plan.

- Strategies for the surviving spouse and the successful transfer of wealth to the next generation.

- Co-ordination with your accountant and lawyer.

Families & People Who Can Benefit Most From Retirement Planning:

Those who are retired or within 10 years of retirement will benefit most if they:

- Wish to find out if they are on track.

- Want to develop a reliable retirement income & cash-flow stream that will last a lifetime.

- Would like to feel in control of their financial future and wish to make sure they will be able to do what they want, when they want.

- Wish to minimize taxes today and in the future.

- Would like to provide for their spouse/family if they are no longer around.

- Desire the efficient transfer of wealth to the next generation.

Cash Flow Planning Questions We Answer For Our Clients

- Do we have enough?

- How much can we spend each year without running out of money?

- How do we create a monthly paycheque to our bank account?

- When should we start to collect government benefits such as Old Age Security and Canada Pension Plan?

- Whose account should the income be withdrawn from?

- How do we coordinate all our sources of income from sources such as CPP, OAS, pensions, investments, TFSAs, RRSPs and RRIFs?

- What do we do with our company savings plans and pensions?

- Should we take an early retirement package?

- How do we reduce the taxes on our income?

Download Your FREE HARD COPY of our recently published Book PRESERVING WEALTH: THE NEXT GENERATION

The definitive guide to protecting, investing, and transferring wealth.

You can purchase a Hard Copy of Preserving Wealth HERE

Download your FREE copy of our White Paper: “Your Retirement Road Map: How to Make the Transition to Retirement HERE

Newsletter Sign Up

Sign up to receive valuable information to assist with your tax, estate and retirement planning.

Your personal information will not be distributed, sold, or traded – it will remain strictly confidential and will only be used for the purpose for which it was provided. For more information on Assante’s commitment to privacy and responsible use of information, please visit www.assante.com/privacy-policy.