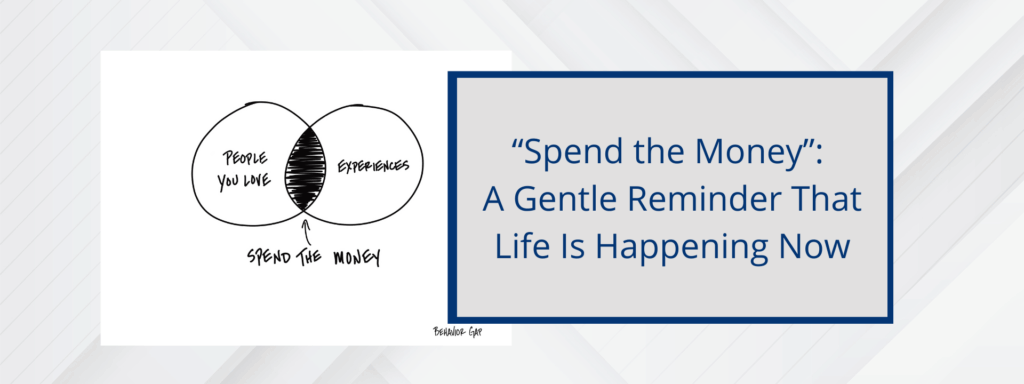

“Spend the Money”: A Gentle Reminder That Life Is Happening Now

Intro: If you’ve ever felt guilty about spending your own money—even after a lifetime of saving – it turns out, you’re not alone. In a recent chat with Carl Richards, creator of The Sketch Guy and author of the new book Your Money: Reimaging Wealth in 101 Simple Sketches, we talked through one of his […]

The Story of Chandler and Monica Retiring with Confidence

How Chandler & Monica Went From “Do We Have Enough?” to Retiring with Confidence Chandler (70) and Monica (73) were in a solid financial position on paper: They had saved diligently and avoided debt for decades. But as Chandler’s April 30, 2025 retirement date approached, they started to worry: They knew they wanted to accomplish […]

Registered Education Savings Plan (RESP)

My kids are 18 and 20, does setting up a new Registered Education Savings Plan (RESP) still make sense? A new client asked if it still made sense to set up a new RESP for his kids, who were aged 18 and 20. His ex-spouse already had an RESP for the children, but he wanted […]

Three of Our Best Insights for September

Monthly One – Two – Three Newsletter RESOURCE: What is Your Bear Market Plan in Retirement? Unfortunately, market declines and recessions will happen regularly, so your financial and retirement plans must consider them when developing your retirement income and spending strategy. You Could Have 6 Bear Markets Over Your Retirement. Since 1956, the Canadian […]

Three of our Best Insights for August

Our Monthly 3-2-1- Newsletter RESOURCE: Preserving Wealth: Chapter Four, Tax Concerns, RRSPs and TFSAs. Uncle Wayne, with his wealth of financial knowledge, shared invaluable lessons on tax concerns, RRSPs, and TFSAs. Understanding these concepts can significantly impact your financial planning and retirement success. In this chapter summary, we’ll walk you through the essential lessons and […]

Game Plan Strategy: August Financial Checklist

This Month’s Focus: Are These Really Your Top Financial Goals? If I asked you to name your top 3 financial goals, what would you say? Most people can answer pretty quickly. But here’s something interesting: When given a broader list of goals to look at first, 73% of people changed their answers. It’s not that […]

Insurance & Risk Management Financial Checklist

Your insurance and risk planning are big pieces of your overall financial picture. Use this checklist to make sure your coverage still fits your goals and any life changes. 1. Review Your Current Insurance ☐ Make sure all your policies are active and current☐ Double-check policy details and listed beneficiaries☐ See if your coverage amounts […]

Game Plan Strategy: Your Monthly Financial Checklist

This Month’s Focus: Tax Planning Tips to Keep More of What You Earn Smart tax planning can make a real difference—not just today, but over the long run. This month’s checklist gives you proactive steps to help lower your tax bill and avoid common oversights. Taking just a few minutes now can help you keep […]

Three of our Best Insights for July

Our Monthly 3-2-1- Newsletter RESOURCE: Preserving Wealth: Chapter One, What are the 7 Key Lessons for Inheritance and Financial Planning? In the first chapter of Preserving Wealth for the Next Generation, we are introduced to a family gathering at their father’s summer cottage in Honey Harbour. It’s the opening weekend of summer, but it’s filled with […]

What are the Different Investment Classes?

Excerpts from the Book – Preserving Wealth – written by Jack Lumsden, MBA, CFP® Before you invest your money, you should understand what the actual investment is. The following passage describes the three basic investment classes. Alice had listened politely but was clearly getting impatient. “So, Uncle Wayne, you know our situations. What should we […]