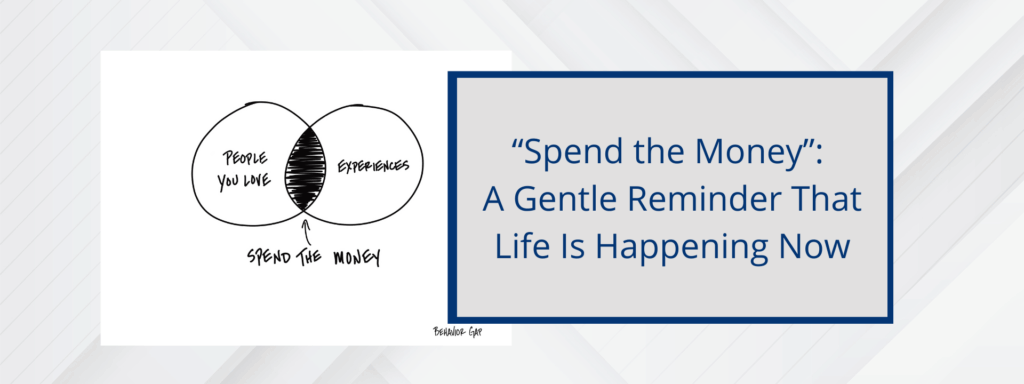

“Spend the Money”: A Gentle Reminder That Life Is Happening Now

Intro: If you’ve ever felt guilty about spending your own money—even after a lifetime of saving – it turns out, you’re not alone. In a recent chat with Carl Richards, creator of The Sketch Guy and author of the new book Your Money: Reimaging Wealth in 101 Simple Sketches, we talked through one of his […]

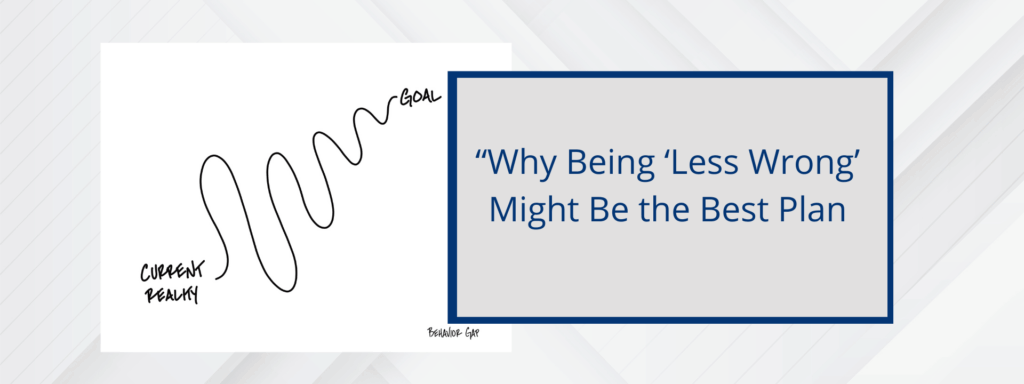

“Why Being ‘Less Wrong’ Might Be the Best Plan”

Ever feel like your financial plan has to be perfect? It doesn’t. In fact, trying to make it perfect can actually hold you back. I recently had the chance to speak with Carl Richards, author of the new book Your “Money: Reimaging Wealth in 101 Simple Sketches” — and one idea from our conversation really […]

Three of Our Best Insights for September

Monthly One – Two – Three Newsletter RESOURCE: What is Your Bear Market Plan in Retirement? Unfortunately, market declines and recessions will happen regularly, so your financial and retirement plans must consider them when developing your retirement income and spending strategy. You Could Have 6 Bear Markets Over Your Retirement. Since 1956, the Canadian […]

Three of our Best Insights for July

Our Monthly 3-2-1- Newsletter RESOURCE: Preserving Wealth: Chapter One, What are the 7 Key Lessons for Inheritance and Financial Planning? In the first chapter of Preserving Wealth for the Next Generation, we are introduced to a family gathering at their father’s summer cottage in Honey Harbour. It’s the opening weekend of summer, but it’s filled with […]

Three of our Best Insights for February 2025

Our Monthly 3-2-1- Newsletter RESOURCE: Nine Tax Strategies to Pay Less Tax in Retirement Your goal in retirement should be to organize your income stream to: The result will be greater spending for you today and potentially greater wealth for the next generation. RESOURCE: The Three Stages of Retirement Spending When retirement planning, you may want […]

Ross and Rachel’s Transition to Retirement: A Clearer Path Forward

Case Study: Ross (64) is gearing up for retirement this year, while Rachel (60) retired last year after dedicating over 35 years to her career. Over the years, they’ve saved diligently using workplace savings plans, RRSPs, and TFSAs. Recently, a family inheritance added another layer of complexity to their financial picture. Like many parents, they […]

Three of our Best Insights for January 2025

Our Monthly 3-2-1- Newsletter Our blog has grown tremendously over the last three years, with over 100 posts, each aimed at providing valuable insights into financial planning. In this compilation, I’ve selected the articles that stand out as essential reads, whether you’re just starting your financial journey to retirement or seeking a refresher. My Top […]

Should we take Advantage of our unused RRSP contribution limits?

Excerpts from the Book – Preserving Wealth – written by Jack Lumsden, MBA, CFP® A common question that we receive every year prior to the RRSP deadline is should we take advantage of our unused RRSP contribution limits? Your RRSP deduction limit is how much you can contribute to your RRSP based on your prior […]

Rebalancing Your Portfolio

Excerpts from the Book – Preserving Wealth – written by Jack Lumsden, MBA, CFP® Today we are going to be reviewing portfolio rebalancing, and how it can be used to your advantage. Sometimes it is hard to know when to make adjustments and when to leave your portfolio alone. By creating a systematic plan, you […]

The Four Essential Family Conversations

Excerpts from the Book – Preserving Wealth – written by Jack Lumsden, MBA, CFP® Based on my experience of helping many families over the years, I have found that there are four essential conversations that families should be having concerning their financial and estate plans. They are: The Estate Documents Conversation The Eldercare Conversation The […]