Download the White Paper: How to Make the Transition to Retirement HERE.

Typically, within 5 years of your projected retirement or work-optional date, it’s important to start taking key steps to ensure a smooth transition. This is a critical period to begin aligning your financial strategies with your future lifestyle goals.

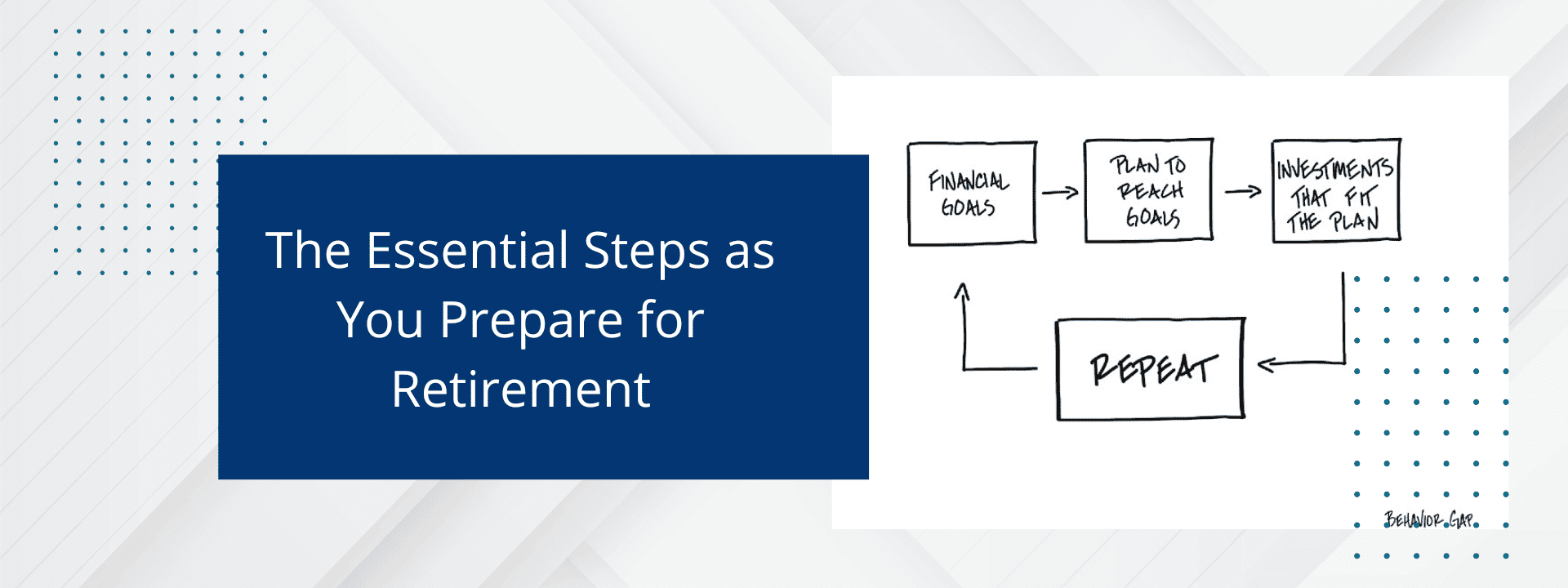

While everyone’s situation is unique, the following essential actions can help you create a personalized Retirement Road Map.

From reviewing your spending patterns and consolidating investments to updating estate plans and preparing for healthcare costs, these steps will guide you toward a financially secure and fulfilling retirement.

Now is the time to plan for both the expected and the unforeseen, ensuring that your retirement years unfold just as you envision.

1. Review the ATM Years (Active, Transition, Maintenance)

When planning for retirement, it’s important to recognize that your spending patterns will shift as you move through different stages of life. These three key phases—Active, Transition, and Maintenance Years—each come with distinct financial demands.

- Active Years:

During the first phase of retirement, the “Active Years,” your spending may increase. This is a time when you are still healthy and eager to travel or engage in hobbies. Your budget will reflect these lifestyle choices as you embrace your newfound freedom. - Transition Years:

In the “Transition Years,” spending may begin to decrease. You might become less active, opting to stay closer to home. With fewer vacations and major expenses, discretionary spending usually lessens. - Maintenance Years:

In the final stage—the “Maintenance Years”—expenses typically decrease further, except for potential healthcare costs. This stage often represents the last decade of life when spending is mainly focused on essential needs and can increase if medical care is required.

2. Plan for HP3 (Health, Purpose, People, Places)

The HP3 which stands for Health, Purpose, People, and Places—addresses the key elements that will shape your well-being and happiness during retirement.

- Health:

Prioritizing physical and mental health is crucial. Develop strategies to stay active, eat well, and maintain mental sharpness. Regular exercise, engaging in hobbies, and staying socially connected are key components of a healthy retirement lifestyle. - Purpose:

With up to 2,000 hours a year no longer dedicated to work, it’s vital to find a new sense of purpose. Whether through volunteering, pursuing passions, or exploring new interests, having a sense of purpose provides structure and fulfillment. - People:

Consider who you want to spend your time with during retirement. Building and maintaining relationships with family, friends, and communities is essential for happiness. Be intentional about creating opportunities for social engagement. - Places:

Think about where you want to live and the places you want to explore. Whether relocating, downsizing, or traveling, it’s important to identify where you want to spend your retirement years.

3. Double O’s – Summarize What You Own and Owe

Create a list of your assets (e.g., homes, investments, savings) and liabilities (e.g., mortgages, loans, credit card debt). This will give you a clear financial snapshot to begin your retirement planning process.

4. Review & Understand Your Company Savings Plans

Review the details of your company-sponsored savings plans, such as defined contribution pension plans or group RRSPs. Ensure you are contributing enough to maximize any employer-matching programs.

5. Evaluate Your Sources of Reliable Income

Examine your options for Canada Pension Plan (CPP) and Old Age Security (OAS) If you have one, your Defined Benefit company pension. Review potential payments and start dates.

6. Consolidate Your Investments

If your retirement and investment accounts are spread across multiple institutions or advisors, consider consolidating them. Consolidation simplifies investment decisions, tax planning, and income sequencing, and may help reduce fees.

7. Maximize Your Retirement Savings

Prioritize contributions to retirement savings vehicles like RRSPs, TFSAs, and non-registered accounts during your peak earning years. Building up non-registered investments and TFSAs can provide flexibility for retirement income and lump sum costs.

8. Review Your Expenses

Reviewing your current and future expenses is essential for a sustainable financial strategy. Here’s how to get started:

- Create a list of your current and projected future expenses.

- Identify where costs may decrease (e.g., commuting) and where spending may increase (e.g., healthcare, travel).

- Categorize your expenses into two groups:

- Core expenses (e.g., housing, utilities) that cannot be changed easily.

- Adaptable expenses (e.g., dining out, entertainment) that can be adjusted to fit your retirement lifestyle.

9. Update Your Estate Documents & Plan

Ensure your will, power of attorney, and beneficiary designations are up to date. Make any necessary changes to reflect your current situation and wishes.

10. Review Your Health Care Plan Options

If your employer does not provide retiree health plans, start reviewing other options. Determine what government plans (i.e., OHIP) will be available at different ages.

11. Obtain Out-of-Country Health Insurance

If you plan to travel, ensure you have health and medical insurance to cover unexpected healthcare costs while abroad and out of province.

12. Pay Down Debt

Prioritize paying off high-interest debt, such as credit cards or personal loans. Reducing debt will free up cash flow in retirement. Ideally, you will want to be mortgage-free by your retirement date.

13. Update Major House Expenses While Working

Address any significant home repairs or upgrades (e.g., roof, furnace, A/C) while you’re still earning regular income.

14. Plan for Automobile Expenses

It’s ideal to have a relatively new vehicle as you transition to retirement. Assess the condition of your vehicles and budget for replacements or repairs.

15. Obtain a Line of Credit While Working

Apply for a line of credit before retirement when it’s easier to qualify. This can provide a safety net for unexpected or emergency expenses.

16. Create a Retirement Income & Cash-Flow Strategy

Develop an initial retirement income and cash flow strategy to determine if you are on track and if any changes are required.

Ensure this strategy accounts for longevity and potential bear markets during retirement. You will also want to review various sequencing options of your sources of income (CPP, OAS, RRIF, TFSAs, Pension, and Non-registered investments) as each can have different start dates and tax consequences, to determine the initial strategy that may be best.

17. Test Drive Your Retirement Budget

Try living on your projected retirement income for a few months to see if it’s realistic. Adjust your spending or savings plan as needed.

18. Do You Need Help?

If managing your retirement income strategy feels overwhelming, consider hiring a CFP® professional who specializes in retirement income planning.

This guide is designed to help you begin navigating the complexities of planning for the transition to retirement. For tailored advice or assistance, please do not hesitate to contact us!

If you enjoyed this, you would love our white paper, Your Retirement Road Map: How to Make the Transition to Retirement You can download it HERE

For your FREE E-Copy of Preserving Wealth, CLICK HERE

What To Do Next

Are You on Track with Your Retirement Strategy? FIND OUT TODAY!

For more information, refer to Preserving Wealth: The Next Generation – The definitive guide to protecting, investing, and transferring Wealth by Jack Lumsden, MBA, CFP® or schedule a call with Jack at 905-332-5503

Jack Lumsden is a Financial Advisor with Assante Financial Management Ltd. The opinions expressed are those of the author and not necessarily those of Assante Financial Management Ltd. Please contact him at 905.332.5503 or visit www.jacklumsden.com to discuss your circumstances before acting on the information above.

Insurance products and services are provided through Assante Estate and Insurance Services Inc.