Serving Burlington, Oakville & Surrounding Areas

REDUCE TAXES – MAXIMIZE INCOME – INVEST SMARTER – PRESERVE WEALTH

Over the past year several clients are considering if it makes sense to sell their home and move into a retirement home using their independent living option. Retirement homes often have a few different living options such as:

• independent living,

• assisted living

• Memory care; these provide some health care for challenges such dementia. Often this may be used while waiting for a Long-Term Care facility.

The average cost for a senior’s space in Ontario is $ 2,815/month according to the CMCH Senior Housing report in 2015, however this will vary depending on the level of service as above and amenities provided.

Distinct from the lifestyle questions/changes, a big concern for seniors is if they can afford it or if it makes sense financially over the longer term, as they do not want to run out of money. The answer comes down to doing some basic math.

• Estimate your new expenses (and compare to your current expenses)

• Review your current sources of income such as; Canada Pension Plan, Old Age Security, Pension Plans, Annuities, RRIFs/LIFs, and investment income.

• Find the income gap, (difference between your new expenses less current income)

• Withdrawal Rate, this is the annual income shortfall divided by the realized value of your home once sold.

• Estimate your time horizon

• Understand and Develop your Retirement Income Solution

Many of the current expenses people have with their own home will change with the move to a retirement facility that has all-inclusive living.

For example, with the move, you may no longer have property taxes, heat, hydro, condo fees, water, meals, lawn care, and home maintenance, as this may be covered by your monthly fee. You will want to confirm exactly what is included in your monthly costs, and most facilities you are looking at will have a checklist to help you out.

For your current income, you have to summarize what you have in terms of guaranteed income, and variable income. Guaranteed income would include Old Age Security, Canada Pension Plan, Private Pensions, and Annuities, and Guaranteed Income Products.

Variable income is income that is not guaranteed and can change based on the investments, and this would include sources such as income from RRIFs/LIFs, TFSAs, and investment income.

You will also have to determine the amount of taxes you are currently paying to determine your current after tax income. (Gather your tax returns as this will have most of this information)

You will want to find out your current income gap if you move. For example:

| New Monthly Expenses | $5,000 |

|---|---|

| Current Monthly Income (After Tax) | $ 3,646 |

| Income Gap | $ 1,354 per month |

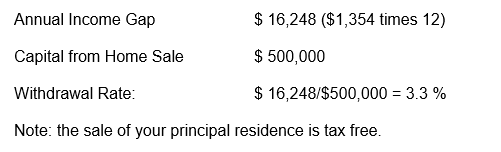

As an example, if you sold your home for $500,000, and your monthly shortfall is $1,354/month, ($16,248/year) the annual withdrawal rate would be:

$16,248/$500,000 = 3.3 %

(Formula for Withdrawal Rate; New Annual Expenses Less Current Annual Income divided by new capital from home sale)

What this means, is that to fund your retirement home, as a starting point, you would have to withdraw as income 3.3 % of your capital per year. Over time this will increase as your costs increase you will also have to do some planning to see if this is sustainable over time based on your time horizon.

In this situation, if you were to earn 0 % return, your capital would last about 30 years.

($500,000/$16,248)

One of the biggest fears that people have is running out of money (real income) in their lifetimes, and the one unknown variable is how long you will need your income to last. I would suggest that you plan to live at least age 96, or longer, depending on you and your spouse’s current health.

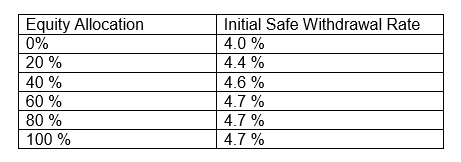

As a guide to see if your withdrawal rate is sustainable over the longer term, a research paper by Morningstar called “Safe Withdrawal Rates for Retirees in Canada Today” outlined the safe withdrawal rates for a 20 year time period based on Asset Allocation:

Initial Safe Withdrawal Rate with 80 % Success

In this example the withdrawal rate is 3.3%, so the initial withdrawal rate appears to be safe. In Part Two, we will review how to create tax effective income from your capital of your home sale.

The next step is to determine how to invest the proceeds in order to obtain the income you desire.

Once you sell your home, you will have a lump sum of cash that you have to decide how to best invest. There are four main options to achieve the income you desire:

• Life Income Annuity

• Guaranteed Income Products

• Interest Only Investments

• Systematic Withdrawal Plan

• Combination of Options

With this option you will receive a guaranteed income for life (can be a joint life with your spouse). Annuities eliminate the risks of our living your savings, and remove market risk, which are transferred to the life insurance company. Once you purchase an annuity, no more decisions are made.

The trade-off for the lifetime guaranteed income is that you no longer have access to your capital. Annuities can be purchased with registered investments, (RRSPs & RRIFs) and the income is fully taxable each year, and annuities purchased with non-registered funds may have a tax advantage.

These options are often called Guaranteed Minimum Withdrawal Benefit (GMWB) products and are offered by Life Insurance Companies through their segregated funds, which are pooled investments like mutual funds. These products provide a lifetime guarantee of income regardless of how the underlying investments perform within the segregated fund contract.

The guaranteed income is based on the original investment amount and may have a joint life benefit. Most often the guaranteed income will be less than what an annuity would provide, however you do have full access to your capital at any time at the current market value. If you cash it in or exceed the guaranteed payment amounts, you can lose the guaranteed payments for life.

Using this option, you would only invest in income- oriented investments such as GICs and live off the interest income it provides. The challenge with this approach is that with the current low interest rate environment, the interest earned may not be enough to fund your income needs.

With this option, you would invest in a globally diversified portfolio using mutual funds, and on a monthly basis (or as required) you withdraw the income you require. The withdrawal amount can be changed to adjust for annual increases in your retirement home.

Often with this strategy, a “bucket” approach is used, where the first 2 years of spending, the “income bucket” is allocated to very conservative investments, and the balance to the longer-term portfolio, the “Long Term Bucket”. At the end of the year, the “Income bucket” is filled up from the “Long Term Bucket” if the market growth has been positive.

What many people may like to do is use an annuity or GMWB to create guaranteed income to match the required spending and use a Systematic Withdrawal Plan (SWP) or lump sum withdrawals to allow for inflation and extra expenses such as travel.

In the last part of this series, we will run through an example of how to create an income stream from the capital from selling your home.

Example:

Ward and June Cleaver are both 80 years old and are selling their home to move into a Retirement Facility using the Independent Living Option. Their house is for sale, and they expect to sell it for $500,000. Their goals are:

• Don’t want to outlive their money

• Like some extra funds if required for trips and fun stuff

• Pay as little tax as possible

• Be able to fund a long-term care facility if required

• Would like to leave some money to their two children, Wally and Theodore.

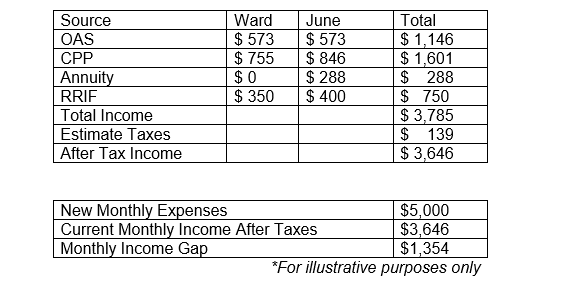

Their current monthly income is as follows:

The annual withdrawal rate that they have to fund is:

With this option you will receive a guaranteed income for life (can be a joint life with your spouse). Annuities eliminate the risks of out living your savings, and remove market risks, which are transferred to the life insurance company. Once you purchase an annuity, no more decisions are made. The trade-off for the lifetime guaranteed income is that you no longer have access to your capital.

If the Cleavers were to purchase a Joint Life Annuity (with a cash refund) for $500,000, with a 100 % payment to the survivor, indexed at 2.5 % per year, the starting monthly income would be $1,837 ($ 22,044/year) This annuity would be indexed at 2.5 % per year, and the value to their estate would be the $500,000, less the payments they have received over time. (Source of annuity quote, Manulife, April 21, 2017, based on a joint life, Male with a date of birth Jan 1, 1937, and Female with a date of birth Jan 1, 1937)

These options are often called Guaranteed Minimum Withdrawal Benefit (GMWB) products and are offered by Life Insurance Companies through their segregated funds, which are pooled investments like mutual funds. These products provide a lifetime guarantee of income regardless of how the underlying investments perform within the segregated fund contract.

If Ward and June were to use the Life Advantage Series with Sun Life, the current joint lifetime payment is 4.8 %. (As of April 21, 2017, based on a joint life, Male with a date of birth Jan 1, 1937, and Female with a date of birth Jan 1, 1937)

So, if they were to invest $ 500,000, the annual income would be $24,000 per year, or $2,000 per month (not indexed – this is why the initial payout is greater than the indexed annuity initial payment). With this option, you would invest the $500,000 into their segregated funds, and have access to your capital if required, although you would lose some of the guaranteed income when you redeem funds.

Using this option, you would only invest in income- oriented investments such as GICs and live off of the interest income it provides.

For a 5-year GIC, you might average around 1.8 % per year, so the annual income from a $500,000 investment would be $9,000/ year or $ 750 per month. Since this is less than the income required, you would have to draw down on your capital over time.

With this option, you would invest in a globally diversified portfolio using mutual funds, and on a monthly basis (or as required) you withdraw the income you require. The withdrawal amount can be changed to adjust for annual increases in your retirement home

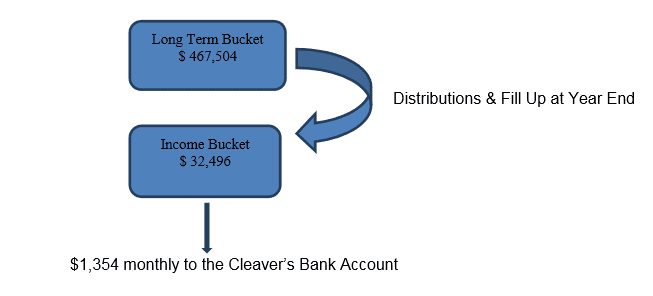

The Cleavers need to be able to pay an additional $ 16,248 dollars a year to fund their retirement home from their capital from the sale of their home.

This option would include using a Systematic Withdrawal Plan with a Bucket approach of an “Income Bucket” and Longer-Term Bucket.”

The strategy would be to invest 2 years of income ($ 32,496) into a short-term investment, the “Income Bucket”, and the balance $467,504 into a longer-term investment portfolio, the “Long Term Bucket.”

What many people may like to do is use an annuity or GMWB to create guaranteed income and use a Systematic Withdrawal Plan (SWP) to allow for inflation and extra expenses such as travel.

This example would use the Guaranteed Income Product with Sun Life, and a Systematic Withdrawal Plan (SWP).

Since Ward and June require about $1,354 per month or $ 16,248 per year, they could: A) Invest $ 338,500 into the Sun Life Advantage Series, and obtain an income of $ 1,354 per month, (4.8 % of 338,500 is $ 16,248/year of income) B) Invest the balance of $ 161,500 into a Globally Diversified Balanced Mutual Fund Portfolio. This can be used to provide for inflation and extra expenses in the future using a SWP when required.

A key concern with any solution is to pay as little taxes as possible, and each solution has unique tax characteristics that we would have to review. While we can’t review all the tax considerations in this article, some key tax considerations would be:

• We would be sure to make use of the Cleavers Tax Free Savings Account, as each of them can have invested up to $52,000 each for 2017

• Corporate class mutual funds would also be reviewed, as they are very tax effective to defer taxation, and to set up a tax effective income stream.

• Different Annuity Types have different tax characteristics which would have to be reviewed.

Each of the preferred options would be run through our retirement income planning program to help define the best option for Ward and June to achieve their goals. Each year we would update their plan and Stress Test it again.

Ideally over the longer term, the portfolio would continue to grow, allowing Ward and June to pay for increases in the monthly costs, have cash for other things they want to do, fund a long term care facility, and leave some cash for Wally and Theodore.

This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Please read the Fund Facts and consult your Assante Advisor before investing.

Rates are not guaranteed and are subject to change at any time without notice.

The definitive guide to protecting, investing, and transferring wealth.

Your personal information will not be distributed, sold, or traded – it will remain strictly confidential and will only be used for the purpose for which it was provided. For more information on Assante’s commitment to privacy and responsible use of information, please visit www.assante.com/privacy-policy.