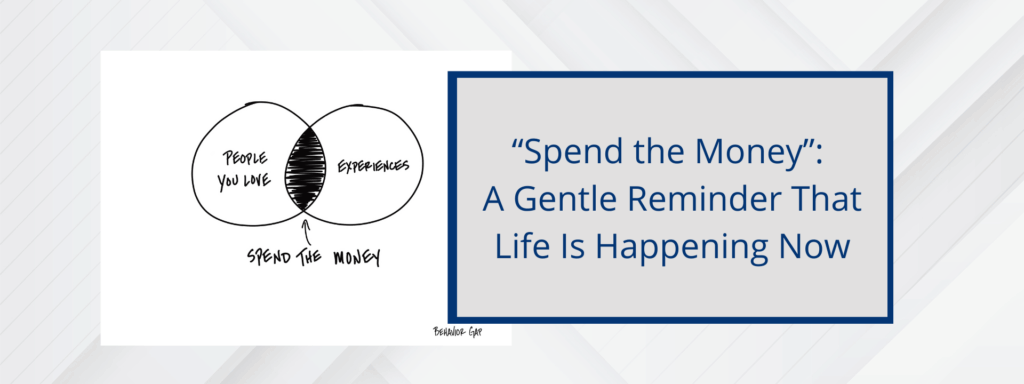

“Spend the Money”: A Gentle Reminder That Life Is Happening Now

Intro: If you’ve ever felt guilty about spending your own money—even after a lifetime of saving – it turns out, you’re not alone. In a recent chat with Carl Richards, creator of The Sketch Guy and author of the new book Your Money: Reimaging Wealth in 101 Simple Sketches, we talked through one of his […]

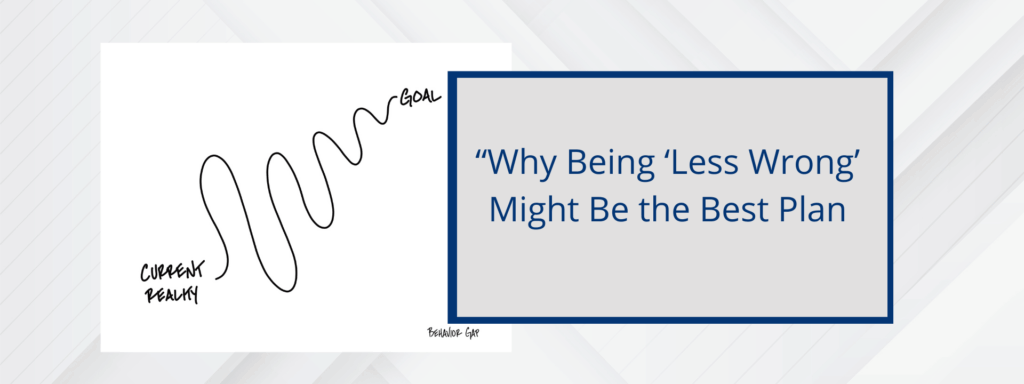

“Why Being ‘Less Wrong’ Might Be the Best Plan”

Ever feel like your financial plan has to be perfect? It doesn’t. In fact, trying to make it perfect can actually hold you back. I recently had the chance to speak with Carl Richards, author of the new book Your “Money: Reimaging Wealth in 101 Simple Sketches” — and one idea from our conversation really […]

The Essential Family Conversations You Should be Having

When the world experienced COVID-19 globally, it brought family planning and care issues to the forefront for many families as concerns for their loved ones and their economic well being have become top of mind. Everyone’s life has been impacted, regardless of age. As a result, families realize they should focus more on these concerns, […]

Registered Education Savings Plan (RESP)

My kids are 18 and 20, does setting up a new Registered Education Savings Plan (RESP) still make sense? A new client asked if it still made sense to set up a new RESP for his kids, who were aged 18 and 20. His ex-spouse already had an RESP for the children, but he wanted […]

Three of Our Best Insights for September

Monthly One – Two – Three Newsletter RESOURCE: What is Your Bear Market Plan in Retirement? Unfortunately, market declines and recessions will happen regularly, so your financial and retirement plans must consider them when developing your retirement income and spending strategy. You Could Have 6 Bear Markets Over Your Retirement. Since 1956, the Canadian […]

Three of our Best Insights for August

Our Monthly 3-2-1- Newsletter RESOURCE: Preserving Wealth: Chapter Four, Tax Concerns, RRSPs and TFSAs. Uncle Wayne, with his wealth of financial knowledge, shared invaluable lessons on tax concerns, RRSPs, and TFSAs. Understanding these concepts can significantly impact your financial planning and retirement success. In this chapter summary, we’ll walk you through the essential lessons and […]

Game Plan Strategy: August Financial Checklist

This Month’s Focus: Are These Really Your Top Financial Goals? If I asked you to name your top 3 financial goals, what would you say? Most people can answer pretty quickly. But here’s something interesting: When given a broader list of goals to look at first, 73% of people changed their answers. It’s not that […]

Insurance & Risk Management Financial Checklist

Your insurance and risk planning are big pieces of your overall financial picture. Use this checklist to make sure your coverage still fits your goals and any life changes. 1. Review Your Current Insurance ☐ Make sure all your policies are active and current☐ Double-check policy details and listed beneficiaries☐ See if your coverage amounts […]

Questions to Ask When Interviewing a Financial Planner

Excerpts from the Book – Preserving Wealth – written by Jack Lumsden, MBA, CFP® Deciding on which financial planner to hire is a particularly important decision for families to make. The following are key questions that FP Canada has designed to help in the selection process. How to Interview a Financial Planner Financial planners can […]

Three of our Best Insights for July

Our Monthly 3-2-1- Newsletter RESOURCE: Preserving Wealth: Chapter One, What are the 7 Key Lessons for Inheritance and Financial Planning? In the first chapter of Preserving Wealth for the Next Generation, we are introduced to a family gathering at their father’s summer cottage in Honey Harbour. It’s the opening weekend of summer, but it’s filled with […]