Serving Burlington, Oakville & Surrounding Areas

REDUCE TAXES – MAXIMIZE INCOME – INVEST SMARTER – PRESERVE WEALTH

A common questions most retirees have is “when should we start to take CPP?” (Canada Pension Plan) Is it better to start as early as you can, or defer it as long as possible?

The Canada Pension Plan (CPP) is a government pension that will pay you an income for life starting at age 65. The current maximum for 2020 is $1,134 per month, indexed to Consumer Price Index (CPI) each year in January. The amount of income you may receive is based on your current age and your contributions since the age of 18.

To determine the amount of CPP you will receive, Service Canada looks at your entire working career from the age of 18 onwards. It will drop out your lowest 7.5 years of income, (and you can apply to exclude years you were disabled or child caring years) in order to determine your years of service, and your actual contributions.

You may elect to take early at age 60 or defer to age 70. If you elect to start to receive CPP prior to age 65, the benefit amount is reduce by 7.20% per year, or 0.60% per month. If you wait to age 70,

the benefit after age 65 increases by 8.4 % per year, or by 0.70 % per month. (Note: you must apply to start to receive the benefits)

One step is to determine the breakeven age, which is the age at which the income received would be the same for both options, and if you live longer, you would receive greater lifetime income.

Let’s look at a real world example. A client obtained a CPP quote, based on retiring at age 60, and electing to receive his CPP at ages 60, or age 65, or age 70. The following is the estimate:

| Age 60 | $ 677.30 per month |

|---|---|

| Age 65 | $ 943.35 per month |

| Age 70 | $1,338.13 per month |

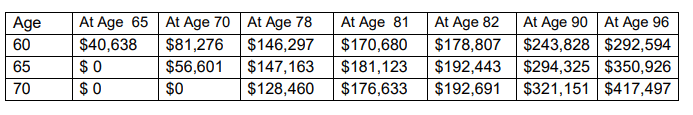

Let’s look at the cumulative cash flow received from starting at each age:

A key factor in your decision on when to start your CPP, is a term that Moshe Milevsky coined “Longevity Risk Aversion.” In the simplest form, it means are you more interested in maximizing your lifestyle today or are you more interested in protecting your future lifestyle?

Rational for starting at age 60:

Rational for Deferring your CPP:

Everyone should obtain a CPP quote for themselves. This will help with the long term planning, as well as do a comparison of you may receive at different ages. If you go to the following Service Canada link, request for CPP quote, you can obtain a projection of your CPP based on the ages you wish to stop working, and when you wish to start to collecting. When you get the CPP estimate, your financial advisor use it their financial planning software to run the various “what if cash flow retirement scenarios”, to help determine when it is best to start based on your specific requirements and views.

This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services. Inc.

Rates are not guaranteed and are subject to change at any time without notice.

The definitive guide to protecting, investing, and transferring wealth.

Your personal information will not be distributed, sold, or traded – it will remain strictly confidential and will only be used for the purpose for which it was provided. For more information on Assante’s commitment to privacy and responsible use of information, please visit www.assante.com/privacy-policy.

Assante Financial Management Ltd. is a member of the Mutual Fund Dealers Association of Canada (“MFDA”) and MFDA Investor Protection Corporation.

Contact Us

905-332-5503 jlumsden@assante.com

1100 Walkers Line

Suite 502

Burlington, Ontario

L7N 2G3

905-332-5503 jlumsden@assante.com

1100 Walkers Line

Suite 204

Burlington, Ontario

L7N 2G3