Smart Tax Strategies for Retirees: The Four Types of Income in Retirement

Planning for taxes in retirement is like putting together a puzzle that is specific to each retiree. The type of income determines how it is taxed. Each year in retirement this must be reviewed to determine what is the best strategy that balances your current year’s income, and your long-term legacy plan. It is a […]

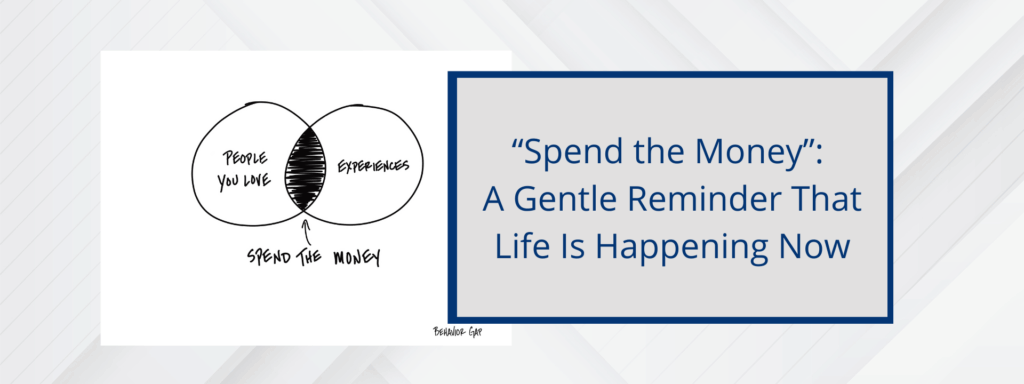

“Spend the Money”: A Gentle Reminder That Life Is Happening Now

Intro: If you’ve ever felt guilty about spending your own money—even after a lifetime of saving – it turns out, you’re not alone. In a recent chat with Carl Richards, creator of The Sketch Guy and author of the new book Your Money: Reimaging Wealth in 101 Simple Sketches, we talked through one of his […]

If you are within 5 years of retirement, do this now!

Excerpts from the Book – Preserving Wealth – written by Jack Lumsden, MBA, CFP® Track your expenses!! If you are thinking about retiring within the next 5 years, you need to determine how much you spend in a year. Your day to day living expenses is the starting point to determine if you are on-track, […]

Ross and Rachel’s Transition to Retirement: A Clearer Path Forward

Case Study: Ross (64) is gearing up for retirement this year, while Rachel (60) retired last year after dedicating over 35 years to her career. Over the years, they’ve saved diligently using workplace savings plans, RRSPs, and TFSAs. Recently, a family inheritance added another layer of complexity to their financial picture. Like many parents, they […]

Three of our Best Insights for January 2025

Our Monthly 3-2-1- Newsletter Our blog has grown tremendously over the last three years, with over 100 posts, each aimed at providing valuable insights into financial planning. In this compilation, I’ve selected the articles that stand out as essential reads, whether you’re just starting your financial journey to retirement or seeking a refresher. My Top […]

What is Your Bear Market Plan in Retirement?

Just like the sketch above by Carl Richards, becoming more conservative after a market decline is not a strategy but a reaction. Everyone should have a plan in place before any market decline or bear market. Unfortunately, market declines and recessions will happen regularly, so your financial and retirement plans must consider them when developing […]

How much Income do you need in Retirement?

Excerpts from the Book – Preserving Wealth – written by Jack Lumsden, MBA, CFP® For your FREE Copy of Preserving Wealth CLICK HERE How Much Income Do You Need in Retirement? The following is an excerpt that describes how much income you need in retirement – “You’ve been retired for a while. How much income […]

How do you Develop a Diversified Portfolio?

How do you Develop a Diversified Portfolio? For your FREE Copy of Preserving Wealth CLICK HERE Excerpts from the Book – Preserving Wealth – written by Jack Lumsden, MBA, CFP® “So how do you actually develop a diversified portfolio?” asked Sally. “I understand the basics between bonds and equities, and clearly I haven’t been doing […]

What are the Retirement Income Planning Options?

Retirement Income Planning Options Excerpts from the Book – Preserving Wealth – written by Jack Lumsden, MBA, CFP® For your FREE E-Copy of Preserving Wealth, CLICK HERE “There are five main options to achieve the cash flow you desire from your own assets: income only investing income-focused investing. guaranteed income: life income annuity/guaranteed income products total […]

Chapter Seven: So, You’re an Executor – What are Your Duties and Liabilities?

For your FREE Copy of Preserving Wealth, CLICK HERE The first three days of our vacation were perfect. The temperature was near thirty degrees, with just enough of a breeze for windsurfing. The kids were behaving, and all seemed right with the world. Sally was at the cottage this week, too but was staying up […]