Serving Burlington, Oakville & Surrounding Areas

REDUCE TAXES – MAXIMIZE INCOME – INVEST SMARTER – PRESERVE WEALTH

Retirement Income Planning is a specialty in the world of financial advice, as it has specific risks that are different than when simply saving for retirement. It requires a different skill set for the advisor in order to be able to plan for the specific risks when developing an income plan that will last a families entire lifetime. They wish to leave something to their children.

From my experience helping retirees develop and implement lifelong income plans, the most common goals/concerns among retired or soon to be retired clients are:

In order for the retiree to feel comfortable in their retirement income plan, all of the above items need to be taken into consideration, as well as the very specific risks to retirement income planning as outline below.

An advisor’s job is to review and plan as much as possible for the key risks when transitioning from the saving phase of your life, to providing a lifetime income from the assets you have accumulated. (De-accumulation stage) These risks are very different from when you are saving for retirement.

A non-negotiable is something that you can’t change, and many of the key risks to retirement are non- negotiable.

The key non-negotiables risks of retirement income planning are:

Risk that you may have some control over:

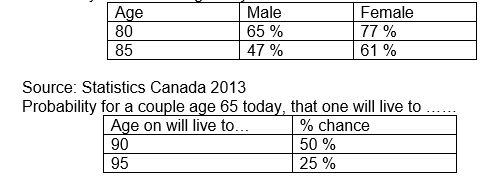

No one knows how long they will need their income to last, but they are sure they don’t want to run out. In general people are living longer today, so most people will have to plan to have their income last a longer time period than previous generations. One of the biggest fear retirees have is outliving their assets, and one of the biggest fears of financial advisors is the same, having their clients outlive their assets. The below chart shows the probability of a healthy 65-year-old living to various ages.

Probability that an average 65-year-old will live to…

Source: Canadian Institute of Actuaries, (UP 94 projected to 2015)

So, if you are 65 today, in all likely hood, you should plan for a 25 to 30-year time frame for retirement, in other words your assets have to last for 30 years when you retire.

A new White Paper from the World Economic Forum, entitled, “We’ll Live to 100 – How can We Afford it?” estimates that 50 % of the babies born today (2017) in Canada, can expect to live to 104. (2121) Just think what this will do to retirement income planning if you have to plan to live to age 100?

(Source: Human Mortality Database, University of California, Berkeley (USA) and Max Planck Institute for Demographic Research (Germany))

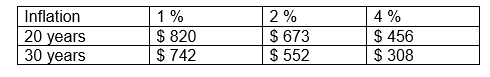

Inflation risk is the risk of not being able to maintain your purchasing power during retirement. As you know, over time everything seems to get more expensive.

What does $1,000 today, buy in…?

So, to maintain your purchasing power, you need to be able to increase your income in retirement, much like an annual raise while you were working.

Taxation Risk is the risk of your tax rates increasing over time, and also paying more in taxes than you otherwise might have, if you had organized your investments in the most tax effective manner. Everyone has to pay taxes, and they always seem to be increasing each year, so everyone needs a tax plan. One of the best ways to increase your income (and to make your money last longer) is to reduce the amount of taxes you have to pay by structuring your income sources tax effectively.

This is needed because retirees can have numerous sources of income that need to be coordinated to reduce current and potentially future taxation. For example, a retired couple may have the following sources of income that have to be coordinated:

In my experience, it is not uncommon for a retired couple to have 10 or more sources of income that have to be coordinated from a:

Different investment income (interest, dividends, capital gains) are taxed at different rates, so you will want to ensure that you the place the investments in the proper location (TFSA,RRIFs, Open accounts) to reduce your taxes, and to maximize any potential government benefits.

Interest Rate Risk

With the current low interest rate environment, most people can’t only invest in “safe investments” to fund their lifestyle such as GICs and Bonds. For example, the yield on Government of Canada 10- year bonds declined from approximately 8.5% in 1991 to about 1.0% in 2017(source: Bank of Canada.) As a result, most people have to invest in assets or investments that do not have guaranteed rate of return, and are market based. (I.e. can go up and down in value and are not guaranteed)

Market Performance

Retires must develop an asset allocation (investments) that provides them the ability to meet their income requirements over their lifetime, and also fit their risk profile. A key concerned once retired, is that if the markets have poor performance several years in a row, it can dramatically affect your income. For example, a 20 % market decline, could mean a 20 % reduction in income. Also, poor investment performance just prior or just as you retire, this can dramatically affect your long-term goals.

The years just prior to retirement and after retirement are the key times when planning to create retirement income. If you have poor market performance just prior and just after retirement, this can dramatically reduce long term income.

Think of it this way, if your investment assets drop by 20 % in year one, and you withdrew another 3%, at the end of your first year of retirement, your assets have depleted by 23 %. To keep the same income in year two of retirement your withdrawal rate would now become 3.89 % — which may be too much. (New withdrawal rate is 3/ (100-23) = 3.89 %.) Just think what would happen again for a few years in a row this is called the “Black Hole” as you can never climb back out of it.

As a result, your retirement income can be determined by luck, which can be either good or bad, depending on if you start withdrawals during good or bad investment markets.

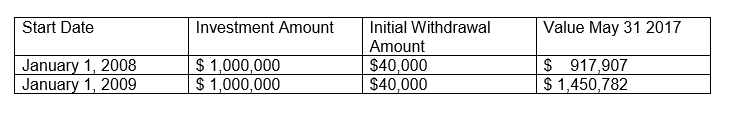

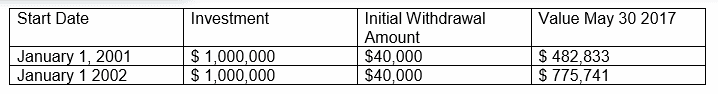

The following example involves investing $1,000,000 at each of the below start dates, with an initial withdrawing rate of 4 % per year, and increasing this by 2 % per year for inflation, utilizing the Morningstar Global Canadian Balanced Index.

Each of the above example was using the Morningstar Global Canadian Balanced Index, (a globally diversified portfolio) so the investment had the same returns in each, however the difference in starting date of only one year had a huge difference in the end value as of May 31. 2017.

Source: Morningstar

A survey by Ledge Marketing for the Canadian Life and Health Insurance Industry, indicates that 74% of respondents haven’t included long term planning in their retirement plans. Heath care can be a significant cost for retirees, and yet many retirees have not included long term care costs into plans or have even considered it. From my perspective, every retiree should account for the potential cost and have a plan for this.

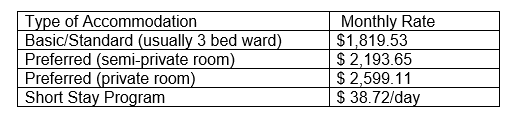

The estimated rates of a Government subsidized long term care home is:

Costs:

Fees for nursing homes in Ontario are set and subsidized by the Ministry of Health and Long-Term Care. The amounts on the above chart, is what is billed to the residents. If the individual can’t pay for the basic accommodation, a subsidy is available.

Another option is private retirement homes and residences, and you would have to pay the entire amount yourself. Private Retirement homes often have a few different living options such as

The average cost for a senior’s space in Ontario is $2,815/month according to the CMCH Senior Housing report in 2015, however this will vary depending on the level of service as above and amenities provided. The price range for private facilities has no upper limit, and vary greatly depending on the city you live in.

This is related to health care, and this is the risk that as people age (and their spouses) they may not be able to make sound financial decisions, and/or health decisions for themselves. With increasing lifespans, this is becoming increasing more common issue.

A closely related risk is Elder fraud and abuse. This is becoming more prevalent today with the aging population, and it is imperative that this risk is planned for well ahead of time.

The reason the above risks are called “non-negotiable’ is that you really can’t control them or change them. You can’t determine how long you will live or your future health care requirements (however by staying fit, you may live longer and/or stay healthier), interest rates and investment returns are beyond your control, as with taxes and inflation, you can’t change or control them. However, with a sound plan in place you can make adjustments as required.

The final risk to retirement income planning is under your control, and this is spending too much, which has been called; Withdrawal Rate Risk. Quite often we see this risk when people haven’t saved enough in order to fund their desired lifestyle, they have underestimate how much they require in retirement, or have not planned for extra health care costs as they age.

This is the risk of withdrawing too large of a dollar amount each year from your capital, and as a result, your capital will erode over time. Your withdrawal rate is the amount of money you need from your investments each year, divided by the total value of your investments.

For example, if you’re total investments equal $1,000,000, and you need to withdraw $30,000 year to cover all of you expenses and taxes, your initial withdrawal rate would be 3.0 % ($30,000/$1,000,000= 3.0 %)

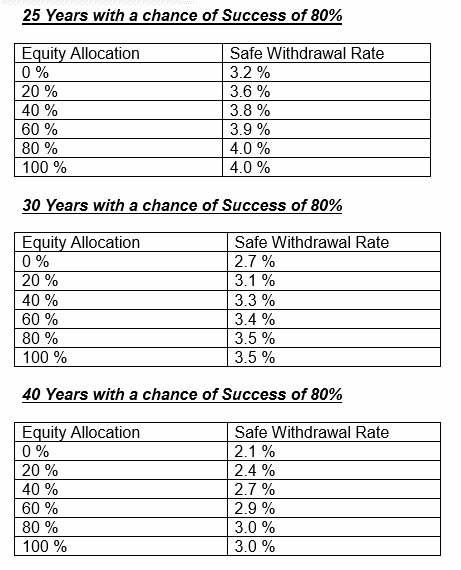

The following charts are from research by Morningstar Canada, and they are the projected safe withdrawal rates in Canada today. Below is a summary based on asset allocation and initial safe withdrawal rates that provides the retiree with an 80% chance of sustaining that rate over a 25, 30- or 40-year period. (Potential time in retirement)

(Note: 80 % success rate means that 80 % of the time your money would last for the time period, and 20 % of the time, your capital would be depleted by the end of the time period)

Source: Safe Withdrawal Rates for Retirees in Canada Today, Morningstar January 2017.

As an example, if you were 65 years old today, and wished to plan to age 95 (30 years), and had a

$100,000 investment account, this safe withdrawal rate with an allocation of 60% to equities would be 3.4% of $100,000, which is $3,400 per year.

(For the full report see: Safe Withdrawal Rates for Retirees in Canada Today)

The above is a good guideline, but in reality, retirees don’t spend the same each year, and often can adjust spending based on the current market conditions. For example, in 2008 when the market declined, retires were able to delay some of their discretionary spending for a few years until the markets rebounded. As well spending can decrease once retirees reach ages around 80 as they tend to be less active, however, this can be offset by increased health care costs as they age.

While all of the above sound like a tremendous amount to overcome and to consider, the issues can be addressed with an advisor who specializes in retirement income planning who understands the specific risks and utilizes a robust financial planning software to review the “what if” scenarios.

Following articles will review strategies for the risks to retirement income planning. Once you are aware of the non-negotiable risks, and your personal spending rate risk, you can begin to craft a plan to suit your needs. However, this plan needs to be to be continually updated and monitored over your entire life.

This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Please read the Fund Facts and consult your Assante Advisor before investing.

Rates are not guaranteed and are subject to change at any time without notice.

The definitive guide to protecting, investing, and transferring wealth.

Your personal information will not be distributed, sold, or traded – it will remain strictly confidential and will only be used for the purpose for which it was provided. For more information on Assante’s commitment to privacy and responsible use of information, please visit www.assante.com/privacy-policy.