Retiring Soon? Already Retired?

Retiring Soon?

Already Retired?

Let’s build a plan that gives you clarity and confidence for what’s next.

We help Canadians 55+ turn their savings into reliable income, reduce taxes, and protect what they’ve worked so hard to build.

No pressure. Just a simple starting point to see where you stand.

Retirement Planning for CanadiansOver the Age of 55

✓ Reduce Taxes ✓Maximize Income ✓Invest Smarter ✓Preserve Wealth

How Close Are You to Retirement?

Getting Ready to Retire?

Wondering things like:

- Am I actually ready? How do I know if I can afford to retire?

- What’s the best way to turn my savings into steady income when the paychecks stop?

Already Retired?

Still asking yourself?

- How do I stay on track with spending and income in retirement?

- What’s the smartest way to handle market ups and downs—and taxes—now that I’m living off my investments?

How We Can Help?

“To me, the people and dreams behind the figures matter the most.”

Jack Lumsden, MBA, CFP® Financial Advisor,

CI Assante Wealth Management Ltd. Burlington ON

Which Retirement Experience Resonates with You?

Transitioning to Retirement

Consistency in Retirement

A Perspective on Risk

Download your FREE COPY of our recently published Book PRESERVING WEALTH: THE NEXT GENERATION

The Definitive Guide to Protecting, Investing, and Transferring Wealth.

You can purchase a Hard Copy of Preserving Wealth HERE

Download Your FREE copy of our White Paper: ‘Your Retirement Road Map: How to Make the Transition to Retirement’ HERE

Retirement Planning Services

Retirement Planning

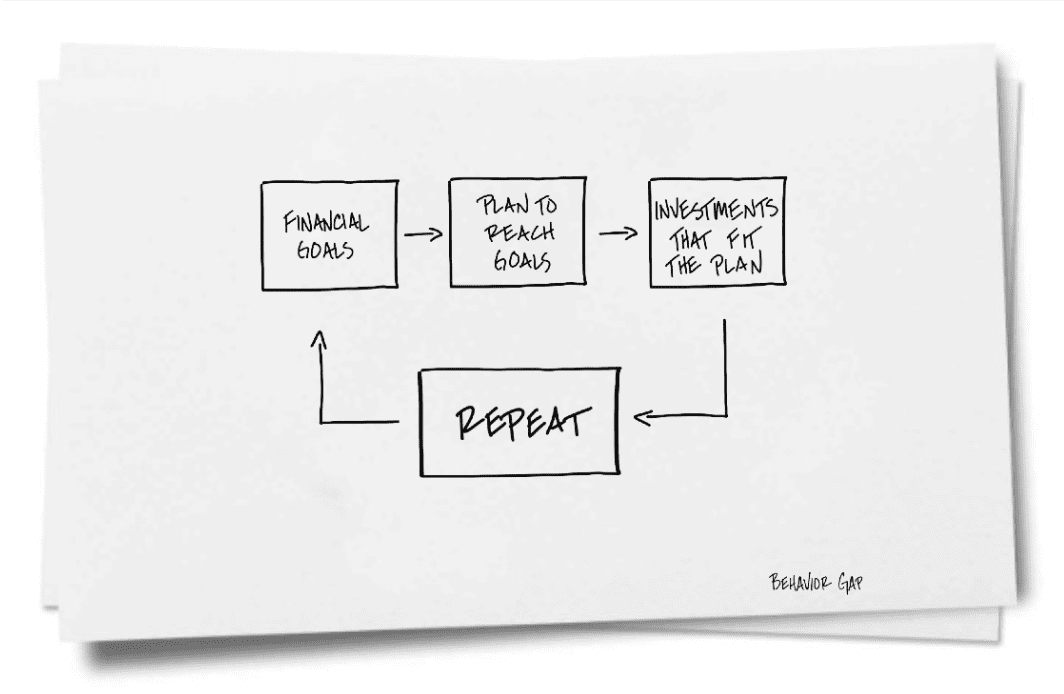

Developing a retirement plan that capitalizes on the opportunities of today is all well and good, but true planning comes from having a strategy that can adapt and is sustainable over the long term. Retirement planning is more than investments. Learn More >

Financial Planning

Financial planning takes a holistic, big picture view of you, your lifestyle, and your financial needs and priorities. Without this broad approach, it’s like trying to see out a window with the curtains half-closed. You need the full view to understand and make the right decisions about every aspect of your finances. Learn More >

Tax Planning

It’s a fact of life in this country; the more you have, the more you have to pay in taxes. Working with professionals during your tax planning process can help as we are adept at keeping more of your money in your pocket, because that is where it belongs. Learn More >

Insurance & Risk Management

Don’t think of it as just the safety net for your wealth management plan (nice to have in place, just in case). These days, insurance planning can also be designed to meet specific investment and estate planning objectives. Learn More >

Estate Planning

Estate planning is a very important component to Strategic Wealth Planning for our clients. We work with our clients to make sure that not only can they leave a lasting legacy, but can assist to develop an effective estate transfer plan to reduce taxes and fees to maximize the value of their estate. Learn More >

Investment Planning

When putting together an investment plan, be rest assured that our goal is to work with clients to prepare a prudent investment strategy based on your objectives, income & retirement income requirements and risk tolerance. Then we will implement it consistently and carefully, with a broad range of best in class products and services. Learn More >

Retirement Planning For A Stronger Future

Planning for your financial future is more than just looking at numbers.

As a CI Assante Wealth Management Ltd., Financial Advisor, I can help you gain peace of mind and achieve your dreams for the future. Whether it’s a worry-free retirement, saving for your children’s education, fulfilling a lifelong ambition, running a prosperous business or leaving a legacy to your loved ones or a cherished cause, I can work with you every step of the way.