Financial Planning Services for Retirement in Burlington, Oakville & Surrounding Areas

Retirement Planning That Puts People First

A Personalized Approach to Retirement Planning - Our Focus for Your Success

Integrated Retirement Services Under One Plan

Our retirement planning services take a holistic, big-picture view of your entire financial life. This integrated approach ensures that each decision supports the others, from investments and cash flow to taxes and estate planning.

Your retirement plan brings together all areas of your financial life, including:

Begin With a Retirement Readiness Assessment

If you’re approaching retirement or already retired, understanding where you stand is the first step.

A Retirement Readiness Assessment helps you:

- Clarify your income and lifestyle expectations

- Identify gaps or opportunities in your current plan

- Gain confidence in your next financial decisions

“To me, the people and dreams behind the figures matter the most.”

Retirement planning isn’t just about numbers — it’s about creating a future that reflects your values, priorities, and goals. Jack Lumsden, MBA, CFP®, provides personalized retirement planning and financial services for Canadians over 55 who want clarity, confidence, and peace of mind as they plan for the years ahead.

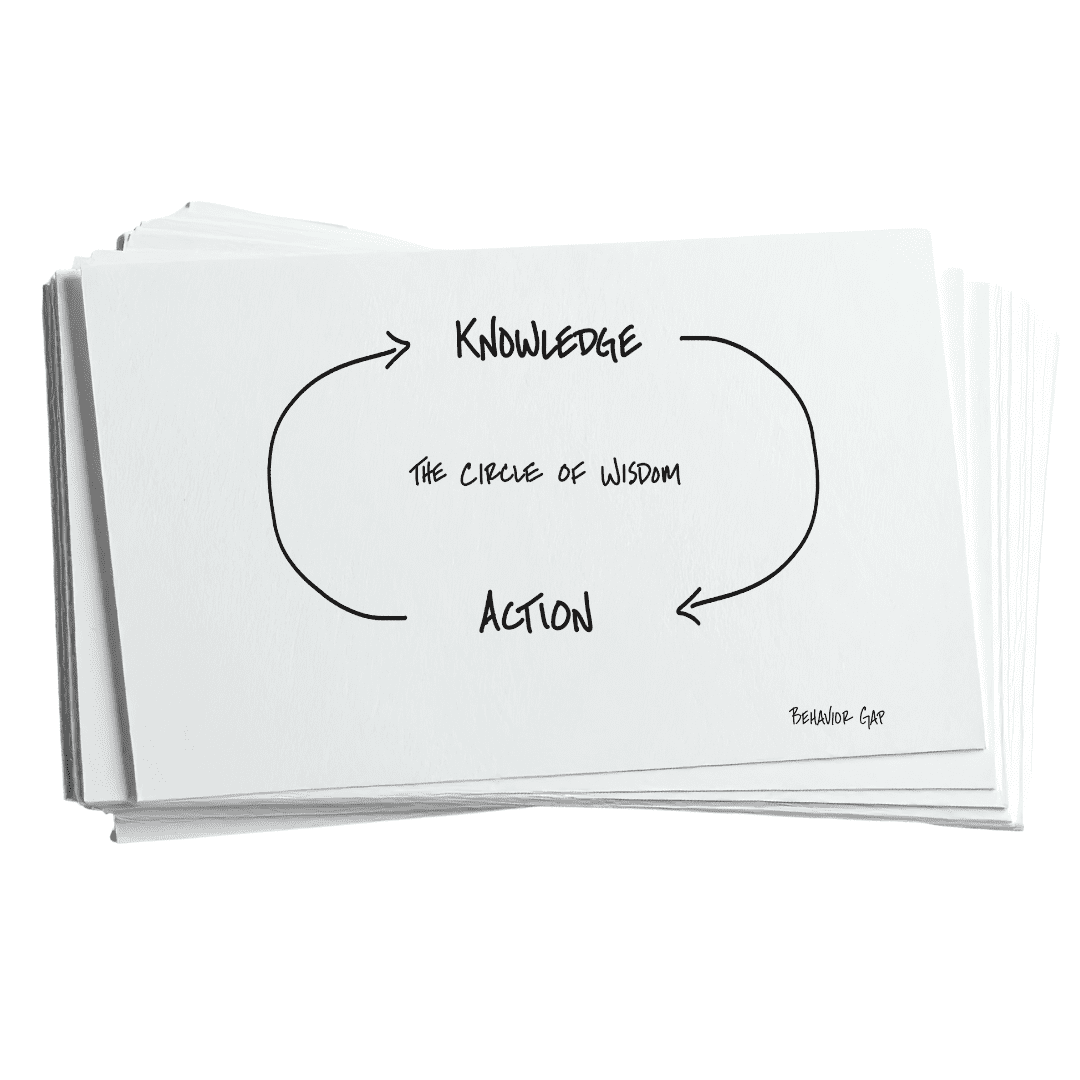

Take a Closer Look at Our Financial Services

Financial Planning takes a holistic, big picture view of you, your lifestyle, and your financial needs and priorities. Without this broad approach, it’s like trying to see out a window with the curtains half-closed. You need the full view to understand and make the right decisions about every aspect of your finances. A comprehensive financial plan covers every area of your financial life, from investments and real estate to insurance and retirement planning.

Our Process is as follows:

- Find out what your family’s dreams, hopes, goals, and desires are.

- Benchmark your current financial reality.

- Co-create the required strategies and plan that will enable you and your family to achieve your dreams, hopes, and desires in the time frame you have selected.

- Execute your specific strategy in the following five key areas:

- retirement and cash-flow strategies,

- investment management,

- tax planning,

- insurance and risk management, and

- estate planning.

- Use a detailed checklist-driven, step-by-step process to ensure nothing is missed in the execution of your plan; and

- Provide an on-going annual review of all aspects of your strategy and plan to make sure they remain aligned with what your family wishes to accomplish over time.

When putting together an investment plan, rest assured that our goal is to work with clients to prepare a prudent investment strategy based on your objectives, income & retirement planning requirements and risk tolerance. Then we will implement it consistently and carefully with a broad range of best-in-class products and services.

- You have access to a broad suite of Managed Portfolio Solutions and products that are customized to your specific liquidity needs, income, growth expectations and family situation.

- Your managed portfolio will be designed to adapt to the market’s daily changes, bumps and grinds, ups and downs. These portfolios are regularly monitored and systematically rebalanced to ensure they reflect your Strategic Retirement Plan and help you to accomplish the financial objectives you have set for yourself.

We meet regularly with our clients in our Burlington office, to discuss the investment plan on an ongoing basis.

- Protecting your current income.

- Sheltering your investments.

- Supplementing your pension at retirement.

- Providing for accident, illness or disability.

- Protecting your business against the loss of key personnel.

- Providing employees with group insurance and retirement plans.

- Planning your business succession.

We can help you implement a program that strengthens and safeguards your family’s financial security through a personalized plan.

It’s a fact of life in Burlington and Oakville and in this country; the more you have, the more you have to pay in taxes. Working with professionals during your tax planning process can help as we are adept at keeping more of your money in your pocket, because that is where it belongs.

There are tax implications to each and every element of your Strategic Retirement Plan and we can deploy a whole arsenal of tactics to minimize your tax burden. We work with clients to utilize all available resources to ensure clients assets and retirement income are managed tax effectively.

Tax-smart strategies include:

- Choosing tax-deferred and tax-exempt options.

- Optimizing tax-preferred income in non-registered plans.

- Establishing trusts and endowments.

- Splitting income among family members.

A key aspect to reduce taxes over time in retirement is to create an effective deacumulation strategy that details how to best sequence the withdrawal of income from your various income sources. This process is reviewed continually to take advantage of each retirees unique and changing tax situation.

Remember, it’s not so much what you make that counts, it’s what you keep.

- Minimizing capital gains taxes and probate fees.

- Maximizing tax-exempt legacy opportunities.

- Strategic charitable gift planning.

- Taking advantage of estate freezes.

Prudent estate planning helps ensure a stress-free transition of your assets to the next generation or intended beneficiaries.