Insights

Learn More About Retirement Planning

Game Plan Strategy: Monthly Financial Checklists

Monthly Financial Checklists As part of our commitment to helping you achieve your financial goals, we have provided you with a monthly financial planning checklist. This article will include the checklists we sent out for July, August, September and November. Each checklist focuses on a key area of a comprehensive

Should we take Advantage of our unused RRSP contribution limits?

Excerpts from the Book – Preserving Wealth – written by Jack Lumsden, MBA, CFP® A common question that we receive every year prior to the RRSP deadline is should we take advantage of our unused RRSP contribution limits? Your RRSP deduction limit is how much you can contribute to your

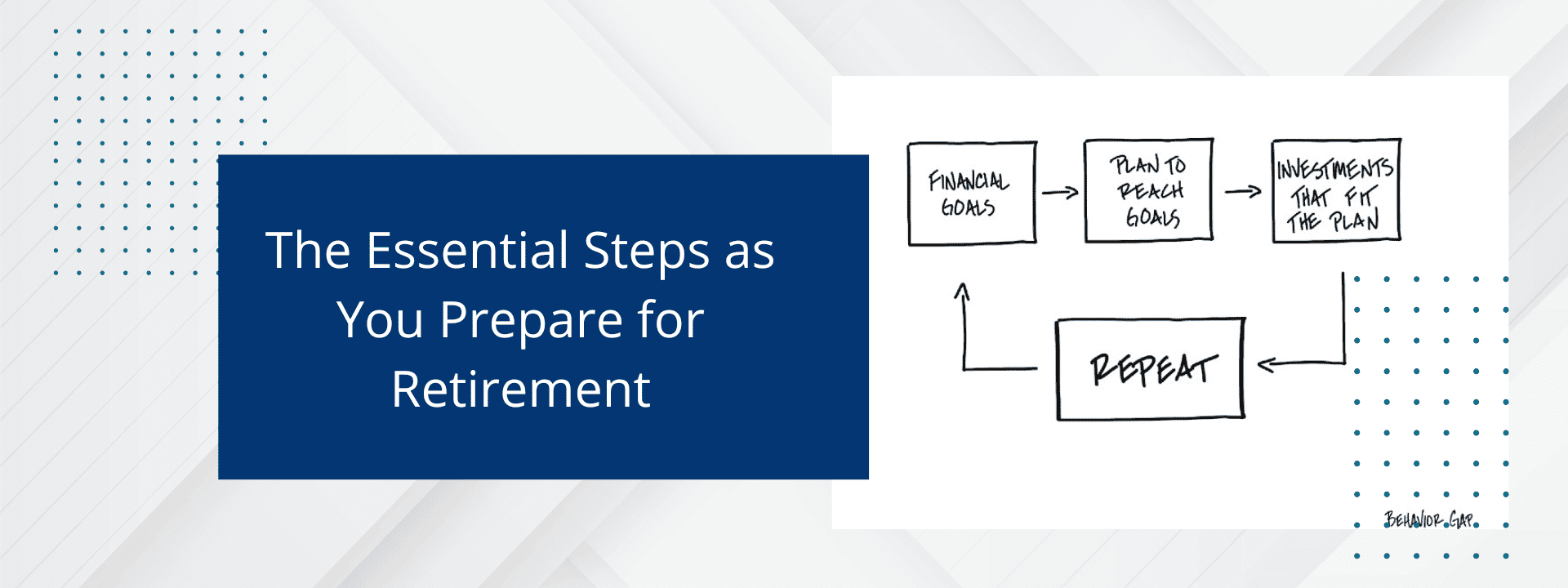

The Essential Steps as You Prepare for Retirement

Download the White Paper: How to Make the Transition to Retirement HERE. Typically, within 5 years of your projected retirement or work-optional date, it’s important to start taking key steps to ensure a smooth transition. This is a critical period to begin aligning your financial strategies with your future lifestyle

Rebalancing Your Portfolio

Excerpts from the Book – Preserving Wealth – written by Jack Lumsden, MBA, CFP® Today we are going to be reviewing portfolio rebalancing, and how it can be used to your advantage. Sometimes it is hard to know when to make adjustments and when to leave your portfolio alone. By

The Four Essential Family Conversations

Excerpts from the Book – Preserving Wealth – written by Jack Lumsden, MBA, CFP® Based on my experience of helping many families over the years, I have found that there are four essential conversations that families should be having concerning their financial and estate plans. They are: The Estate Documents

You better have a Plan for a Retirement Home

“You better have a Plan for a Retirement Home, as I am not funding that bill.” Excerpts from the Book – Preserving Wealth – written by Jack Lumsden, MBA, CFP® While having dinner with our daughter Paige the other night, the topic of money came up. Paige told us, “you

Game Plan Strategy: Monthly Financial Checklists

Should we take Advantage of our unused RRSP contribution limits?

The Essential Steps as You Prepare for Retirement

Rebalancing Your Portfolio

The Four Essential Family Conversations

You better have a Plan for a Retirement Home

Download your FREE COPY of our recently published Book PRESERVING WEALTH: THE NEXT GENERATION

The Definitive Guide to Protecting, Investing, and Transferring Wealth.

You can purchase a Hard Copy of Preserving Wealth HERE

Download Your FREE copy of our White Paper: ‘Your Retirement Road Map: How to Make the Transition to Retirement’ HERE