“Why Being ‘Less Wrong’ Might Be the Best Plan”

Ever feel like your financial plan has to be perfect? It doesn’t. In fact, trying to make it perfect can actually hold you back. I recently had the chance to speak with Carl Richards, author of the new book Your “Money: Reimaging Wealth in 101 Simple Sketches” — and one idea from our conversation really […]

The Story of Chandler and Monica Retiring with Confidence

How Chandler & Monica Went From “Do We Have Enough?” to Retiring with Confidence Chandler (70) and Monica (73) were in a solid financial position on paper: They had saved diligently and avoided debt for decades. But as Chandler’s April 30, 2025 retirement date approached, they started to worry: They knew they wanted to accomplish […]

Three of Our Best Insights for September

Monthly One – Two – Three Newsletter RESOURCE: What is Your Bear Market Plan in Retirement? Unfortunately, market declines and recessions will happen regularly, so your financial and retirement plans must consider them when developing your retirement income and spending strategy. You Could Have 6 Bear Markets Over Your Retirement. Since 1956, the Canadian […]

Three of our Best Insights for August

Our Monthly 3-2-1- Newsletter RESOURCE: Preserving Wealth: Chapter Four, Tax Concerns, RRSPs and TFSAs. Uncle Wayne, with his wealth of financial knowledge, shared invaluable lessons on tax concerns, RRSPs, and TFSAs. Understanding these concepts can significantly impact your financial planning and retirement success. In this chapter summary, we’ll walk you through the essential lessons and […]

Three of our Best Insights for July

Our Monthly 3-2-1- Newsletter RESOURCE: Preserving Wealth: Chapter One, What are the 7 Key Lessons for Inheritance and Financial Planning? In the first chapter of Preserving Wealth for the Next Generation, we are introduced to a family gathering at their father’s summer cottage in Honey Harbour. It’s the opening weekend of summer, but it’s filled with […]

Three of our best Insights for May

Our Monthly 3-2-1- Newsletter RESOURCE: What are the Retirement Income Investment Options As you transition from your working years to retirement or optional work years, creating a cash flow stream from your investments is critical to retirement planning. There are five main retirement investment options to consider when developing a prudent plan for retirement cash […]

The R6 Retirement Playbook™ A Smarter Way to Retire with Confidence

Retirement today isn’t what it used to be. People are living longer, everything gets more expensive, markets are unpredictable, and tax rules keep changing. That’s why we created the R6 Retirement Playbook™ — a simple, six-part process to help you build income you can count on, reduce taxes, protect your lifestyle, stay flexible, and feel […]

RRSP Maturity Options: What You Need to Know

You don’t have to wait until you’re 71 to convert your RRSP. You can do it anytime before then, depending on what works best for your retirement income strategy. The key is choosing the right option based on your goals, cash flow needs, and tax situation. If you are turning 71 this year, you must […]

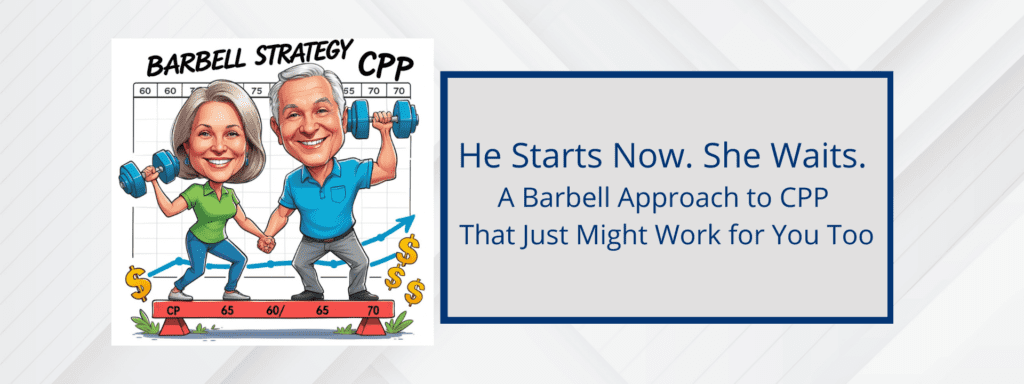

He Starts Now. She Waits. CPP and Retirement

A Barbell Approach to CPP That Just Might Work for You Too Ross and Rachel are a couple I’ve been working with for years. Rachel retired a while ago. Ross is planning to wrap up work at the beginning of 2026. He’ll have a fully indexed pension that covers their income needs pretty well—and they’ve […]

Why Every Retiree Needs a Bear Market Plan

Let’s be honest—market declines aren’t maybe in retirement. They are when. A typical retirement lasts 30 years, and during that time, there could be five or six bear markets. That’s five or six times the market could drop by 20% or more. And while we don’t know when those drops will happen, we do know […]