Menu

REDUCE TAXES – MAXIMIZE INCOME – INVEST SMARTER – PRESERVE WEALTH

“If I had Million Dollars” was a song released by the Bare Naked Ladies in 1992.

At that time, the majority of my friends had been married for few years, started to have kids, and perhaps started saving for retirement.

I heard the song the other day, and the last lyrics of the song are “If I had a million dollars, I’d be rich” and it got me thinking. So let’s say as a family you have saved a million dollars in your RRSPs, how much income would it provide today?

So I decided to do an “annuity check” to see what an immediate annuity would provide today as income. While I am not suggesting that everyone purchase an annuity with their RRSPs, the “annuity check” does provide a good benchmark on how much income you could generate today from a million dollar investment.

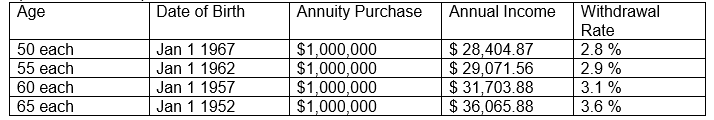

The following income chart is based on purchasing an annuity today for a million dollars for a couple. (Male and female)

What an annuity provides for the couple above, is that in exchange for the $1,000,000 from their RRSPs, they are guaranteed an income as long as one of them is alive. Each year the income is indexed (increases) by 2.0%. Upon the first death, the payments are reduced by 30%. This is basically purchasing your own pension.

Another way to check this is to review the projected maximum withdrawal rate today if you were to invest the $1,000,000, rather than buying an annuity. For example, if your total investments are $1,000,000, and you need to withdraw $25,000/year to cover all of you expenses and taxes, your initial withdrawal rate would be 2.5%. ($25,000/$1,000,000= 2.5 %).

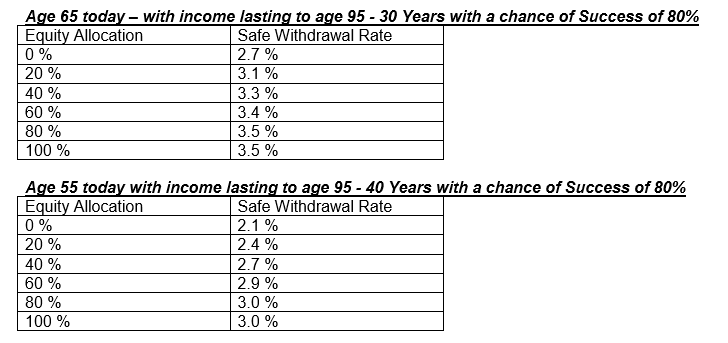

The following charts are from research by Morningstar Canada, and they are the projected safe withdrawal rates in Canada today. Below is a summary based on asset allocation and initial safe withdrawal rates that provides the retiree with an 80% chance of sustaining that rate over a 30 or 40 year period. (Potential time in retirement)

(Note: 80 % success rate means that 80 % of the time your money would last for the time period, and 20 % of the time, your capital would be depleted by the end of the time period).

Source: Safe Withdrawal Rates for Retirees in Canada Today, Morningstar January 2017. As an example, if you were both 55 years old today, and wished to plan to age 95 (40 years), and had a $1,000,000 investment account with an allocation of 60 % to equities, the safe withdrawal rate would be 2.9 % of $1,000,000, which is $29,000 per year. ($29,071 for the annuity at the same age today)

(For the full report see: Safe Withdrawal Rates for Retirees in Canada Today) So, the question to ask yourself is, if we are 55 years old today, with a million dollars, could you live on $29,000/year? Clearly, you would have to factor in Canada Pension Plan and Old Age Security, and any other pension incomes you may have. In other words “how much do you need to save on your own?”

So, while a million dollars is a lot of money, it may not provide as much income as you may think. In your financial plan, you have to determine how much capital you need to save in addition to your sources of guaranteed income (CPP/OAS/Pensions), to provide the lifestyle your family desires. If you don’t know how much enough is, contact your financial advisor to find this out, or contact us at jlumsden@assante.com for this essential analysis.

This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the Fund Facts and consult your Assante Advisor before investing.

Rates are not guaranteed and are subject to change at any time without notice.

The definitive guide to protecting, investing, and transferring wealth.

Lorem ipsum dolor sit orot amet, consectetur adip scing

elit. Proin rutrum euismod dolor, ultricies aliq luam off

kool or taka ekolor.

Your personal information will not be distributed, sold, or traded – it will remain strictly confidential and will only be used for the purpose for which it was provided. For more information on Assante’s commitment to privacy and responsible use of information, please visit www.assante.com/privacy-policy.

Assante Financial Management Ltd. is a member of the Mutual Fund Dealers Association of Canada (“MFDA”) and MFDA Investor Protection Corporation.

Contact Us

905-332-5503 jlumsden@assante.com

1100 Walkers Line

Suite 502

Burlington, Ontario

L7N 2G3

905-332-5503 jlumsden@assante.com

1100 Walkers Line

Suite 204

Burlington, Ontario

L7N 2G3