Menu

Serving Burlington, Oakville & Surrounding Areas

REDUCE TAXES – MAXIMIZE INCOME – INVEST SMARTER – PRESERVE WEALTH

When working with clients developing financial and retirement plans, a key question is “How long do you want to plan for?” The reason this is very important, as one of the greatest risk to retirement is “longevity risk”; that is outliving our money.

No one knows how long they will need there income to last, but they are sure they don’t want to run out. In general people are living longer today, so most people will have to plan to have their income last a longer time period than previous generations. One of the biggest fear retirees have is outliving there assets, and one of the biggest fear of financial advisors is the same, having their clients outlive their assets.

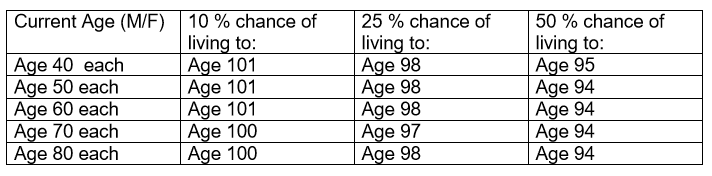

The Financial Planning Standard Council of Canada (FPSC) has some guidelines for projecting life expectancy in financial plans. Below is a summary of the probability of one spouse living to specific ages.

Source: FPSC

What the above table means, if a couple are both age 50 today, there is a 10% chance that one of them will live to age 101, a 25% chance that one of them will live to 98, and a 50% chance that one of them will live to age 94.

The FPSC recommends that planners based their plans on an age that has no greater than a 25% chance of running out of money. (Unless they have specific health risks currently) So, based on the above chart, most couples today should plan on a life expectancy of 98 years old.

When I talk to clients about planning to live to age 100, many say they don’t want to live that long, as they look at it as a negative, based on declining health. However, what if you can live to age 100 being healthy? What if you take care of your self today by eating right, being fit, you could extend your healthy living to much greater ages. Just think about the potential changes in medicine and technology over the next 25 years. So if you are age 55 today, think about all of the potential medical advances by the time you are age 80, and how these changes may extend your healthy life span at that time.

I would suggest revisiting your retirement plans, and look at the ages you are projecting them to. Are the projections based on the current realities? If not, update them. (Now!!) If you need help, contact us at jlumsden@assante.com for this essential analysis.

This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see me for individual financial advice based on your personal circumstances. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the Fund Facts and consult your Assante Advisor before investing.

The definitive guide to protecting, investing, and transferring wealth.

Your personal information will not be distributed, sold, or traded – it will remain strictly confidential and will only be used for the purpose for which it was provided. For more information on Assante’s commitment to privacy and responsible use of information, please visit www.assante.com/privacy-policy.

Assante Financial Management Ltd. is a member of the Mutual Fund Dealers Association of Canada (“MFDA”) and MFDA Investor Protection Corporation.

Contact Us

905-332-5503 jlumsden@assante.com

1100 Walkers Line

Suite 502

Burlington, Ontario

L7N 2G3

905-332-5503 jlumsden@assante.com

1100 Walkers Line

Suite 204

Burlington, Ontario

L7N 2G3